The amount of property taxes you pay on your property may be changing greatly effective July 1, 2021, and it’s important that you pay attention to the recent town-wide revaluation to make sure your taxes are not significantly increased. If you live in Fairfield, Westport or Bridgeport, you will be getting a notice in the mail soon from the Tax Assessor that will list your property’s new assessed value for the next five years. At Russo & Rizio, we represent dozens of properties each year in actions against municipalities to challenge unfair and inaccurate property tax assessments. We are paying particularly close attention to the October 1, 2020 town-wide revaluations in Fairfield, Westport and Bridgeport. We are concerned that the recent spike in property sales in town has the potential to lead to many properties being appraised at values much higher than their actual market value. We want to help protect your interests and keep your tax bill down.

How Does the Revaluation Process Work?

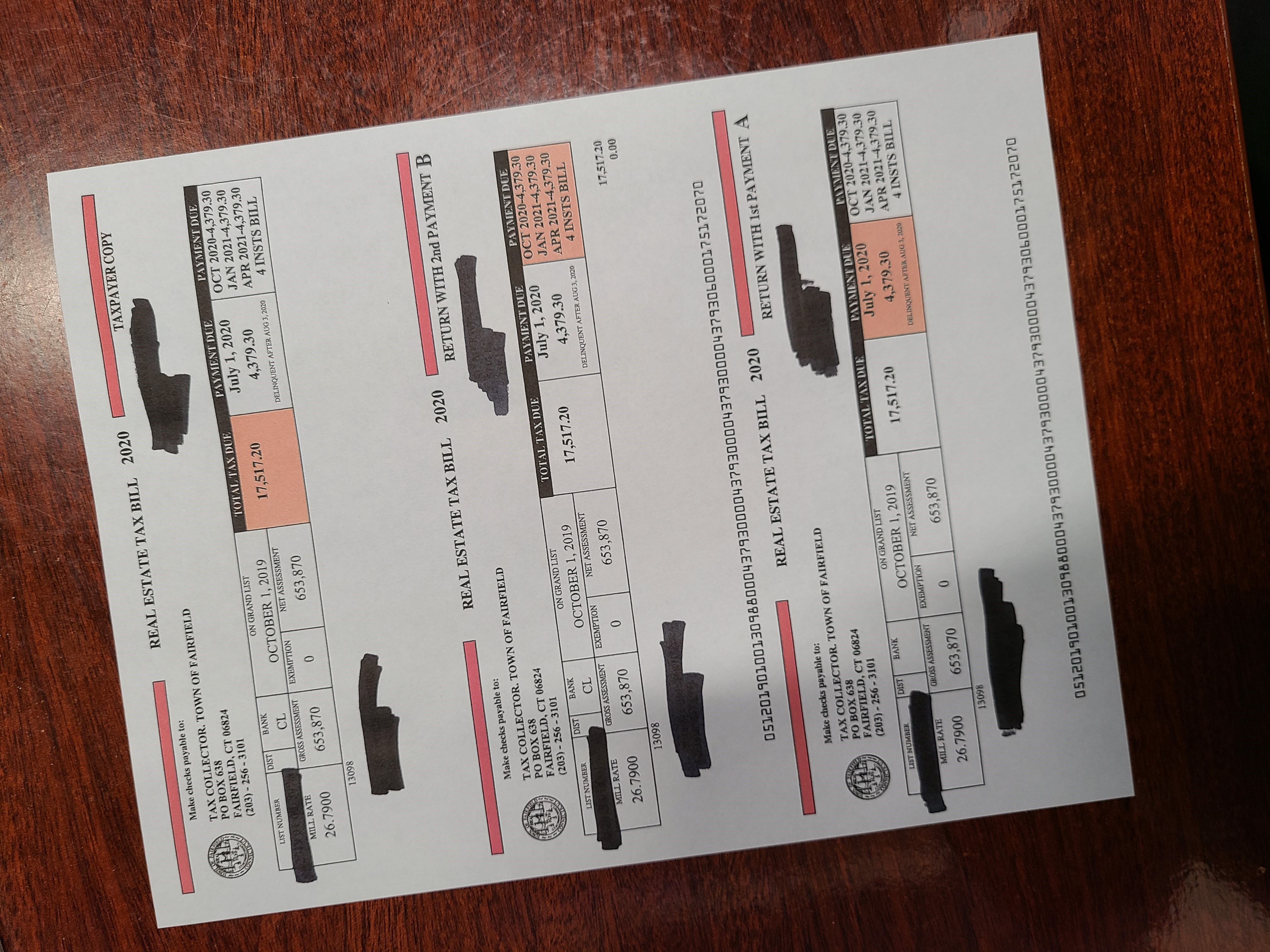

In each town in Connecticut, an owner of real property pays property taxes that are determined by multiplying seventy percent of the appraised value of the property by the mill rate set by the Town to levy taxes. “Appraised” value refers to the value the Town believes a property is worth at the time of assessment. “Assessed” value is merely seventy percent of the appraised value.

Every five years, the State of Connecticut requires municipalities to re-appraise all the real property in town to determine their value as a basis for the payment of property taxes. The Town hires an outside appraisal company that uses a complex computer algorithm to attempt to determine the market value of every piece of real property in town as of October 1st of the revaluation year. In this case, that’s October 1, 2020.

It has been our experience that the revaluation process tends to over-generalize and lead to multiple errors, especially in towns with a diverse range of properties such as Fairfield, Westport and Bridgeport (as opposed to Weston that’s nearly all two-acre residential properties). Often the appraisal company tends to miss unique characteristics of properties that affect their values. They also tend to overvalue entire streets or even neighborhoods based on one or two sales that were above market price.

How Does the Appeal Process Work?

The law of the State of Connecticut allows any property owner to appeal the assessment of their property to the Fairfield Board of Assessment Appeals (the “BAA”). Any such appeal must be filed by February 20th, unless the Town has filed for an extension to March 20th. Appealing parties are usually granted a hearing date within thirty days to make their case to the BAA. Hearings are conducted by one member of the BAA who meets with the appealing party or their attorney to hear the appealing party’s concerns. Often, it is helpful to bring an appraisal conducted by a licensed appraiser and well as specific comparable sales from the three months leading up to October 1, 2020 that demonstrate that the Town’s proposed value for the property is too high. The member of the BAA conducting the hearing will then take your conversation back to the full Board of Appeals for discussion with the Tax Assessor without you present, and a decision is usually issued within one to three weeks.

If you own a commercial property or an apartment building worth over one million dollars, the BAA may decide not to hear your appeal. Then your only remedy will be to appeal to the Superior Court.

If you disagree with the decision of the BAA, or if the BAA refuses to hear your appeal as described above, you may then appeal to the Connecticut Superior Court. Your matter will be assigned to the Tax Session in the New Britain Superior Court that handles appeals from the Boards of Assessment Appeals for the entire state. This appeal is in fact a lawsuit against the Town and if you are unable to settle your matter with the Town Attorney, it will result in a full trial being held before a Superior Court Judge who will listen to both sides’ appraisers and render a decision as to the accurate value of your property for purposes of taxation. Fortunately, it has been our experience that very few appeals need to be tried where competent legal counsel is involved. Often a compromise can be reached between the property owner and the Town that justifies resolving the matter before trial.

Next Steps

Right now, you need to be on the lookout for the notice from the Tax Assessor listing your new property value as of October 1st, 2020. When you receive it, please call us to discuss what it means. You should receive notice by the end of the year.

You can also check your town’s Assessor’s page to see if it has been updated yet. (Fairfield’s is already updated)

Town of Fairfield Assessments: http://gis.vgsi.com/fairfieldct/

Town of Westport Assessments: https://gis.vgsi.com/westportct/

City of Bridgeport Assessments: https://gis.vgsi.com/bridgeportct/

Do not just assume that if it goes down, it is good news. As all the other properties in town are also changing what matters is your new assessment’s relation to the Grand List as a whole and not its relation to your prior assessment. We can help you determine whether it makes sense to appeal.

We are expecting the number of appeals this year to be higher in several of the surrounding towns. This means appraisers are going to be inundated with requests and you are going to want to make sure that you start the process early. The February 20th deadline for appeals to the BAA is not flexible so please get in touch with us as soon as you receive the notice.